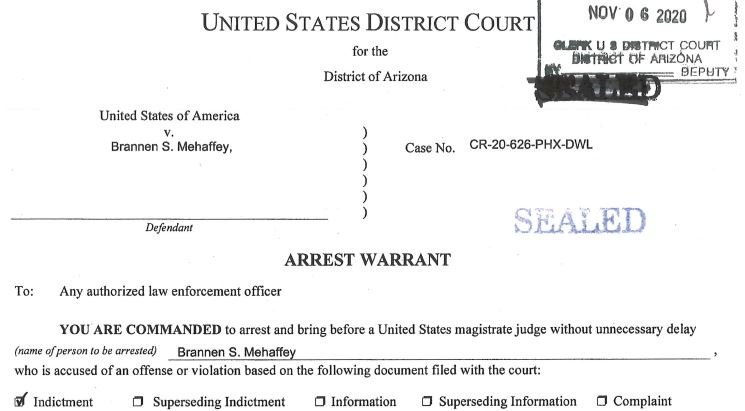

The U.S. Department of Justice (DOJ) issued a statement mentioning that Brannen Mehaddey, CEO of a Bitcoin ATM company, has been found guilty of laundering money through LocalBitcoins.com and other platforms. The defendant faces a total of seven charges.

Mehaffey controlled a network of Bitcoin ATMs called BASH, with more than 20 locations on shopping malls, bars and restaurants in Texas, the DOJ said.

The defendant also offered to exchange Bitcoin units for cash on platforms such as Craigslist and LocalBitcoins.com. The authorities claim that Mehaffery’s main attraction was that his services included full discretion: “What you do with your Bitcoins is your business and not mine; I don’t need to know how you use them,” the defendant once mentioned to one of the undercover agents who worked on the case.

The DOJ report also mentions that between January 2018 and March 2020, the defendant went on to transfer more than $4 million USD through the multiple bank accounts under his control. It is not yet clear how much money generated its fraudulent scheme, although the authorities continue to track any fund potentially associated with BASH.

As mentioned above, the arrest was made possible by the work of a team of undercover agents. After the first encounters, the agents managed to contact Mehaffey with the alleged intention of making transactions with him; although the agents suggested that they obtained their income illegally, the defendant had no problem with trading it to Bitcoin.

In order to go unnoticed, the accused even divided his clients’ transactions into smaller transactions, as the bank transactions of more money are subject to scrutiny from the authorities.

The U.S. Bank Secrecy Act stipulates that banks and other financial institutions must report to the IRS on any transaction greater than $10,000 USD, helping to identify potential criminal activities such as money laundering. This legislation also provides for penalties for dividing large transactions into parties to try to evade detection by tax authorities.

He is a cyber security and malware researcher. He studied Computer Science and started working as a cyber security analyst in 2006. He is actively working as an cyber security investigator. He also worked for different security companies. His everyday job includes researching about new cyber security incidents. Also he has deep level of knowledge in enterprise security implementation.